salt tax repeal new york

The Tax Cuts and Jobs Act of 2017 TCJA set a limit on the amount of state and local taxes SALT that people can deduct from their federal taxes. Most of the states House delegation threatened to oppose future tax legislation.

Repealing The Salt Deduction Cap Can It Bring Ny Nj Property Tax Relief Youtube

Americans who rely on the state and local tax SALT deduction at tax time may be in luck.

. As members of the New York Congressional Delegation we urge you to insist on full repeal of the limitation on the State and Local Tax SALT deduction passed by Congress in 2017 and signed into. Kathy Hochul and Attorney General Letitia James was also supported by Connecticut. High-tax states lost 10000 break under Trump administration.

New York and Idaho both recently passed legislation to work around the controversial 2017 tax law feature known as the SALT cap. Their states created an optional tax letting owners of passthrough entitieswhere income flows through and is taxed on the ownership levelcircumvent the 10000 limit on deductions. Connecticut and New York have revived their efforts to overturn the SALT cap the federal deduction for state and local taxes that.

But its not entirely clear when or if that cap put in place as part of the 2017 federal tax. A new bill seeks to repeal the 10000 cap on state and local tax deductions. New York Democrats are turning up the heat on their party to repeal the cap on state and local tax deductions.

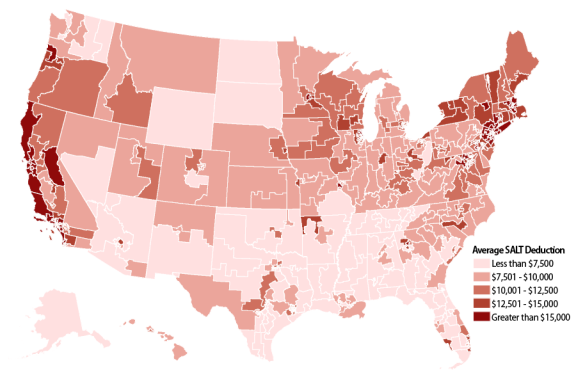

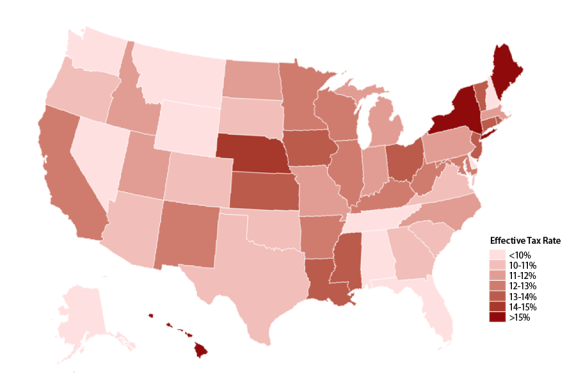

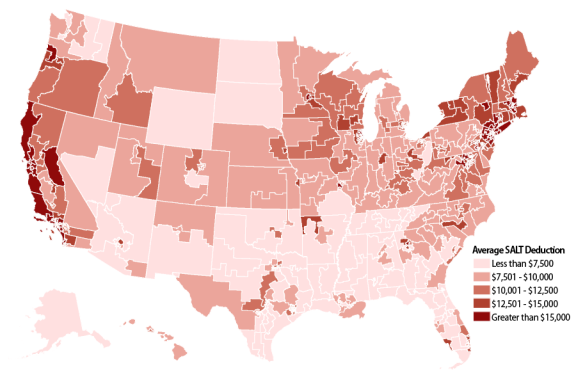

The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns. The federal Tax Cuts and Jobs Act of 2017 eliminated full deductibility of state and local taxes SALT effectively costing New Yorkers 153 billion. The Supreme Court on Monday declined to review a challenge to the 10000 ceiling imposed on the state and local tax SALT deduction one of the most controversial provisions of the 2017 tax bill.

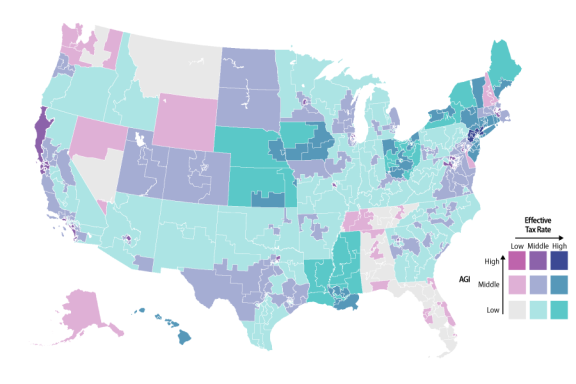

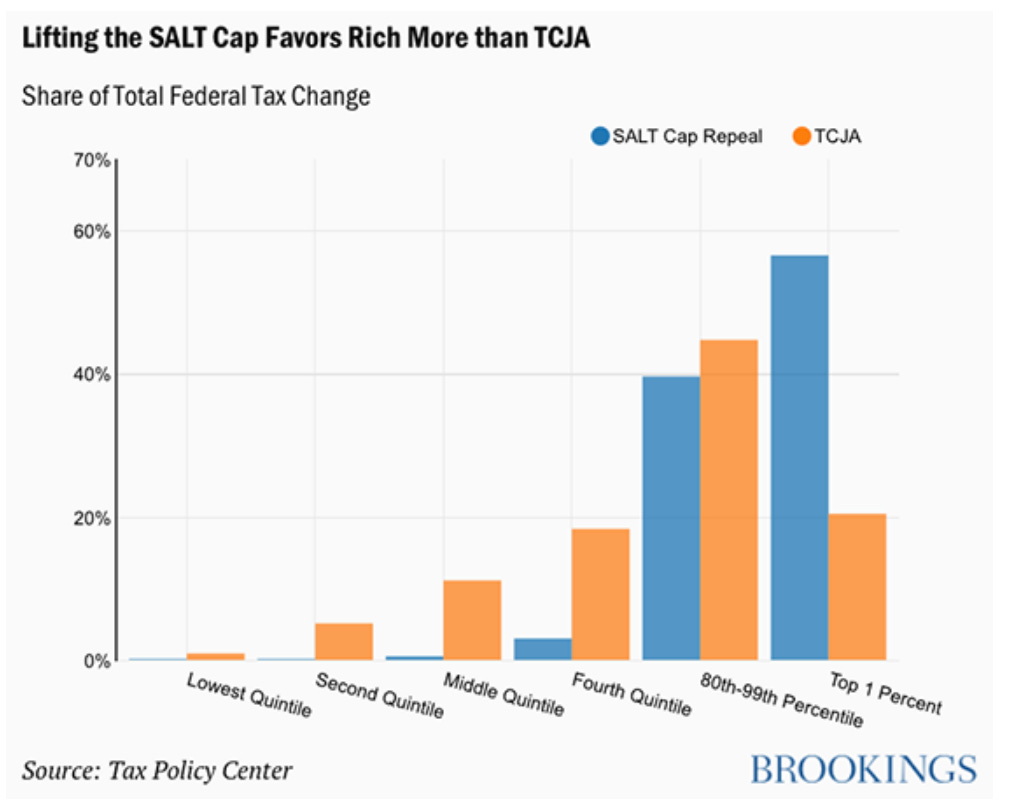

Cuomo said the repeal is the single best piece of action for the state of. Only about 9 of households would benefit from a repeal of the Tax Cuts and Jobs Acts TCJA 10000 cap on the state and local property tax SALT deduction wrote Tax Policy Center analyst. That law the Tax Cuts and Jobs Act of 2017 did cut taxes for some but increased taxes on many not rich homeowners in certain states notably New York where it costs people an extra 12 billion.

Cuomo Sees Blow From New York Tax-Hike Plan Offset by SALT Repeal. They wont really count when the 10000 cap on state and local tax deductions is repealed by Congress. Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue states like New York New.

New Guidance Affected Industries and What to Know Before the October 15 2021 Deadline. Blue states like New York and California want to restore the unlimited state and local tax or SALT deduction. The cap was implemented as part of the 2017 Tax Cuts and Jobs Act.

New York state on Monday made another attempt to overturn the 10000 cap on state and local tax deductions amid broader efforts in Congress to raise the ceiling and undo part of a 2017 tax law. New York is taking another run at repealing SALT cap. The push backed by Gov.

New York seeks Supreme Court review of SALT cap. Bidens DOJ is trying to preserve the 10000 limiteven though Trump enacted it. 178 1 minute read.

A Democratic proposal aims. A bi-partisan group of county leaders from around the state joined with Congressman Tom Souzzi D-Long Island Queens and the New York State Association of Counties NYSAC on April 28 to call for an end to the cap on the deductibility of state and local taxes known as SALT. Andrew Cuomos spin on the tax hikes in the state budget approved this month is this.

Whats worse is that the law disproportionately hurts Democratic states like New York which already contributes 356 billion more annually to the federal government than it gets back. Democrats from high-tax states like New York New Jersey and California have spent years promising to repeal the cap and are poised to lift it to 80000 through 2030 before reducing it back to. For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or.

New Yorks SALT Workaround. The tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction. New York governor says states taxes to be lower after repeal.

Tom Suozzi has taken a leading role in fighting to restore a tax deduction that is important to people who live in and around New York City and in doing so might be laying. Starting with the 2018 tax year the maximum SALT deduction available was 10000. Editor May 10 2021.

October 05 2021. Recently NYSAC sent a letter. Salt tax repeal new york Wednesday March 9 2022 Edit.

The Salt Cap Overview And Analysis Everycrsreport Com

California Approves Salt Cap Workaround The Cpa Journal

Homeowner Taxes Salt Deductions Cap Increase In Doubt How It Could Double Your Payment Gobankingrates

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Wealthy Americans May Get 10 Times Bigger Tax Cut Than Middle Class Families In Biden Bill

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

Dems Don T Repeal The Salt Cap Do This Instead Itep

Lawmakers Launch Bipartisan Caucus On Salt Deduction The Hill

Appeals Court Rules Against States Challenging Salt Deduction Cap Route Fifty

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

The Salt Cap Overview And Analysis Everycrsreport Com

The Heroic Congressional Fight To Save The Rich

The Heroic Congressional Fight To Save The Rich

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

The Salt Cap Overview And Analysis Everycrsreport Com

The Salt Cap Overview And Analysis Everycrsreport Com

Research The Leader Board The Newsroom Republican Leader

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule