unfiled tax returns 10 years

If you fail to file your back tax returns. For Offers in Compromise you need to file all your tax returns.

What Should I Do If I Have Years Of Unfiled Tax Returns Nj Taxes

Missed the IRS Tax Return Filing Deadline.

. You must prove the tax bill will cause you a tremendous burden like having to sell your home for the hardship case. The IRS filed substitute tax returns based off 1099-MISC forms submitted by third parties. However in practice the IRS rarely goes past the past six years for non-filing enforcement.

Its surprisingly common in Canada for people to fall ten or more years behind on filing their taxes according to Debbie Horovitch a virtual tax professional based in Toronto. Any information statements Forms W-2 1099 that you may have for the year s in question. Have multiple years of unfiled taxes tax returns.

You may be eligible to receive a refund for the last 3 years even if you have unfiled tax returns. You can possibly face imprisonment for a length of time proportional to each year of the unfiled tax return. Many have not filed tax returns for 10 years or even 15 years or maybe never.

Tax agencies time limit is specific to the state so. The good news is that the IRS does not require you to go back 20 years or even 10 years on your unfiled tax returns. While the irs does not put a bulk of taxpayers in jail or monetary fines.

Whatever the reason having several years of unfiled tax returns can create problems whether you are due a refund or have a balance due to. In fact youre only protected by a time limit if you file your taxes at which point the IRS only has 10 years to collect from the date you filed. Trptax The irs can go back to any unfiled year and assess a tax deficiency along with penalties.

Havent Filed Taxes in 3 Years. Based in the Southeast US we have 40 years. Forget or dont know they need to file.

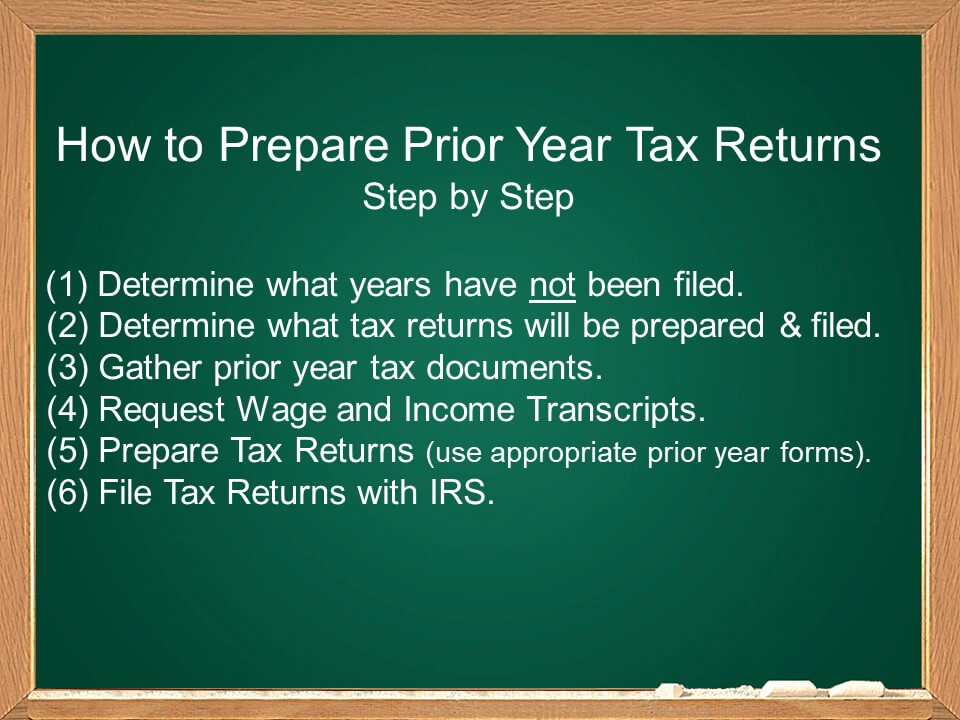

If you owe money and do not file your taxes the IRS will assess a failure to file penalty which is 5 of the back taxes owed per month the return is late up to a maximum of 25. Unfiled Taxes Last Year. For taxpayers who havent filed in previous years the IRS has current and prior year tax forms and instructions available.

Income tax return Forms 1065 1120 1120S and many other types of. To ensure youre providing the IRS with the correct information you need to use the correct tax. They wonder if they should file if.

Many are worried about what the statute of limitations is on unfiled tax returns. The deadline for claiming refunds on 2016 tax returns is April 15 2020. In most cases the IRS requires you to go back and file your.

The IRS did not deduct any business expenses resulting in a substantial tax liability. Havent Filed Taxes in 2 Years. Tax rules deductions and credits change every year.

A copy of your notices especially the most recent notices on the unfiled tax years. Havent Filed Taxes in 5 Years. An original return claiming a refund must be filed within 3 years of its due date for a refund to be allowed in most instances.

And you will receive the interest on that refund as well. Use a licensed Enrolled Agent at Tax Resolution to settle liabilities and get current. The IRS can go back to any unfiled year and assess a tax deficiency along with penalties.

While the IRS does not put a bulk of taxpayers in jail or monetary fines 25000 for. The IRS Policy Statement 5-133 does not apply to business returns employment tax returns Forms 940 941 944. Havent Filed Taxes in 10 Years.

After the expiration of the three-year period the refund. Find the Tax Forms for the Unfiled Years.

Faqs About Unfiled Tax Returns And Not Filing Your Tax Return

Unfiled Tax Returns The Law Offices Of Craig Zimmerman

10 Or More Years Of Unfiled Tax Return A Guide On How To Resolve It Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Tax Alliance What Happens If You Have Unfiled Tax Returns

Tax Returns Not Filed Massey Company Cpa Atlanta Georgia

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Astonishingly An Irs Non Filer Has 10 Of Unfiled Tax Returns

Unfiled Tax Returns Back Taxes Help Dallas Fort Worth Tx Myirsteam

Unfiled Tax Returns East Coast Tax Consulting Group

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Irs Letter 1615 Mail Overdue Tax Returns H R Block

Unfiled Tax Returns Guide Revermann Law

Irs Backlog Has People Wondering Why Resend 2020 Returns

Scott Allen E A If You Need To File Back Tax Returns In Chandler Az Tax Debt Advisors

Irs Notice Cp515 Tax Return Not Filed H R Block

How Far Back Can The Irs Go For Unfiled Taxes Lendio

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block